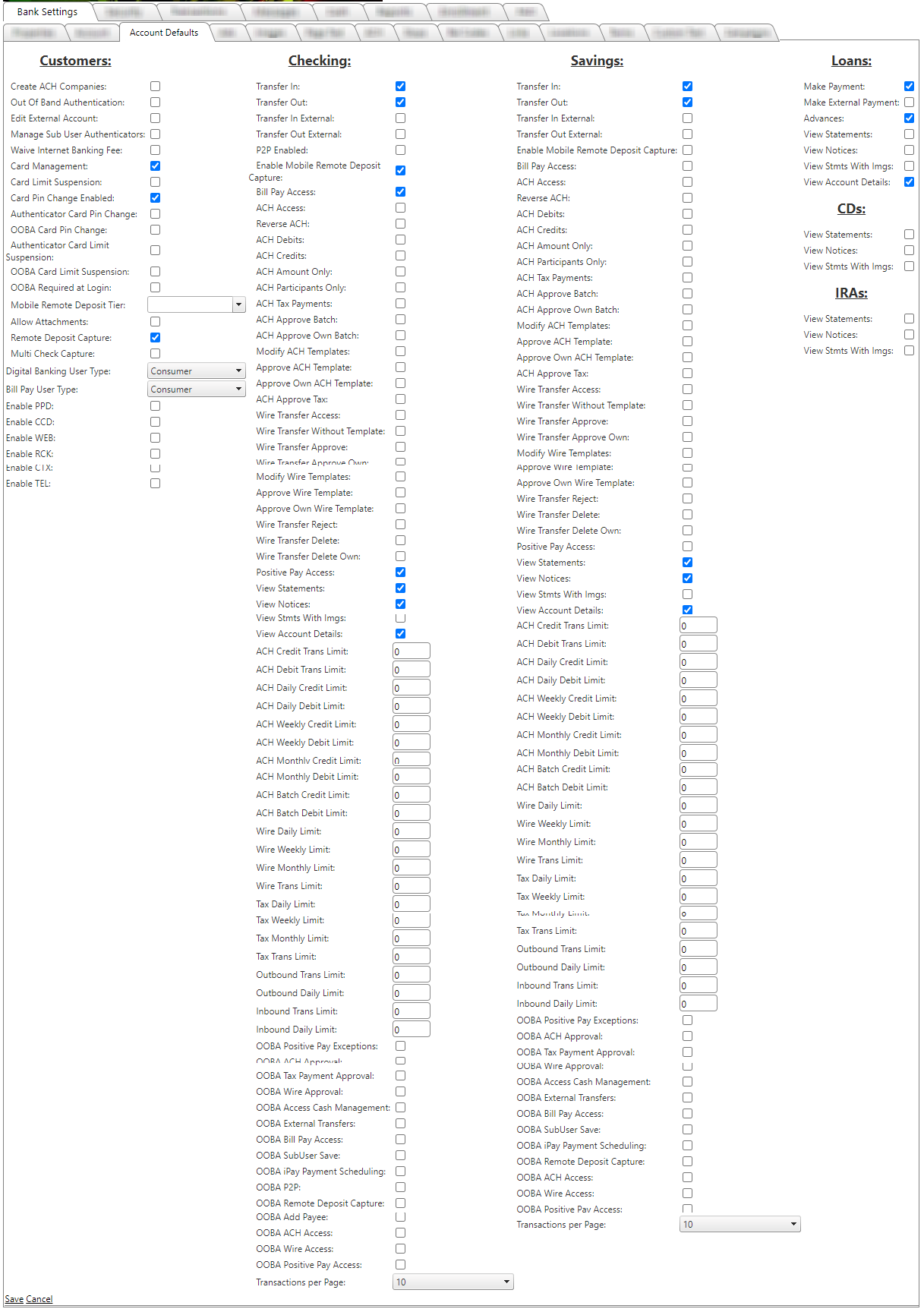

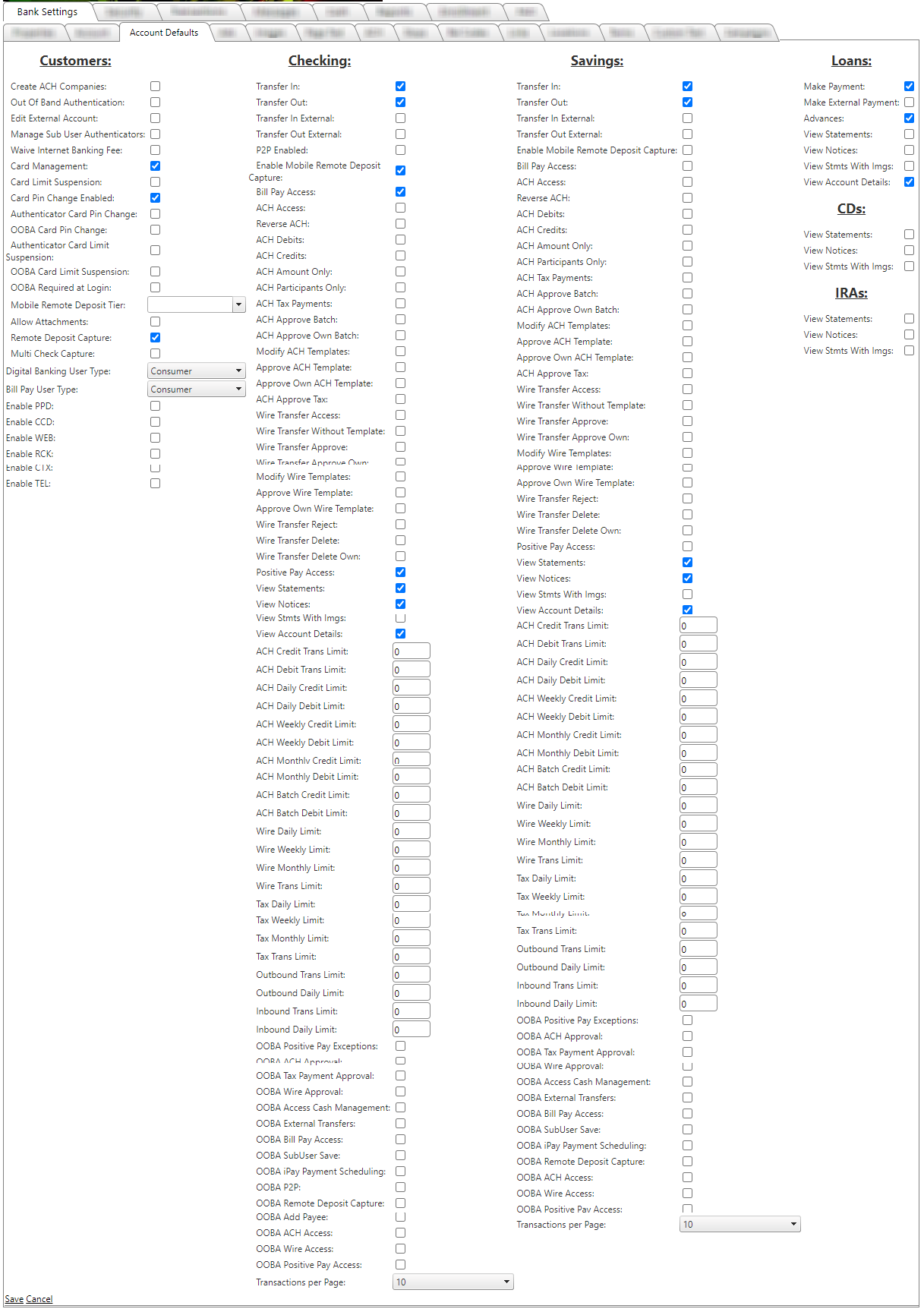

Account Defaults tab

These default settings apply any time a new account is added on to the system, whether it was added manually, through auto-relate, or through auto-enrollment.

All settings applied on this page will be applied to New Accounts.

Customers:

- Create ACH Companies: Allows user the ability to create ACH companies.

- Out of Band Authentication: Enables OOBA functionality so that individual permissions around OOBA can be set.

- Edit External Account: Allows the customer to set up external accounts on digital banking.

- Manage Sub User Authentications: Allows the master user to assign tokens to a sub-user.

- Waive Internet Banking Fee: Not currently used.

- Card Management: Allows user to toggle debit cards on/off and activate new debit cards through digital banking.

- Card Limit Suspension: Allows user to suspend limits for 30 minutes allowing them access to greater funds based on bank set limit.

- Card Pin Change Enabled: Allows customers to change their PIN .

- Authenticator Card Pin Change: Requires token authentication prior to the customer being able to complete a PIN change.

- OOBA Card Pin Change: Requires OOBA authentication prior to the customer being able to complete the a PIN change.

- Authenticator Card Limit Suspension: Requires token authentication prior to completing a limit suspension request .

- OOBA Card Limit Suspension: Requires Out of-Band Authentication (OOBA) before the limit increase can be requested. The customer will be required to enter a one-time Passcode before submitting a Temporary Spending Limit Increase Request.

- OOBA Required at Login: Only displayed if OOBA is enabled. Will require the customer authenticate via OOBA prior to logging into the system.

- Mobile Remote Deposit Tier: The tier elected will be what limit amount is set for the user when performing mRDC. Set the default Tier level at Gold, Silver, Bronze or even Blank. Whatever the default MRDT is, it will be the default for self-enrolled users.The bank can even set as Blank Tier which can only be an option for self-enrolled users only. When Bank Admins create a new user, they will be forced to choose from Gold, Silver or Bronze tier levels. When the Bank does have a default MRDT set, it will be listed as the first option when setting up a new user.

- Allow Attachments: Default setting for the Send Attachments switch on the Edit Customer screen. When enabled, bank customers are defaulted to be able to attach files to support emails.

- Remote Deposit Capture: Enables single sign on for remote deposit capture for the user.

- Multi Check Capture: Allows a customer the ability to perform multiple check capture instead of one image at a time.

- Digital Banking User Type: Defines what user type the customer is by default and display on the user record. Also controls visual settings for banks with multiple brands.

- Bill Pay User Type: Defines what bill pay functionality a customer sees: consumer or business.

- Enable PPD: Allows a customer to submit SEC code PPD files.

- Enable CCD: Allows a customer to submit SEC Code CCD files.

- Enable WEB: Allows a customer to submit SEC Code WEB files.

- Enable RCK: Allows a customer to submit SEC Code RCK files.

- Enable CTX: Allows a customer to submit SEC Code CTX files.

- Enable TEL: Allows a customer to submit SEC Code TEL files.

Checking and Savings:

- Transfer In: Allows a customer to transfer funds into the account.

- Transfer Out: Allows a customer to transfer funds out of the account.

- Transfer In External: Allows a customer to transfer into the account from an external account.

- Transfer External Out: Allows a customer to transfer funds out of the account to an external account.

- P2P Enabled: Allows a customer to perform person to person transfers.

- Enable Mobile Remote Deposit Capture: Allows a customer to capture a check on their device and submit in for deposit.

- Bill Pay Access: Allows accounts to have bill pay access.

- ACH Access: Allows accounts to have ACH access .

- Reverse ACH: Allows a customer the ability to perform an ACH file reversal on the account.

- ACH Debits: Allows the customer the ability to submit debit ach files.

- ACH Credits: Allows the customer the ability to submit credit ach files.

- ACH Amount Only: Amount is the only payee field that is available to the originator to edit when sending a template or historical batch for new origination.

- ACH Participants Only: When checked, the user can only build a batch with participants that are already associated with the company. They will not be able to add a new participant. .

- ACH Tax Payments: Allows a user to submit tax payments .

- ACH Approve Batch: Allows user to approve an ach batch submitted .

- ACH Approve Own Batch: Allows a user to approve their own ach batch.

- Modify ACH Templates: Allows user the ability to edit ach templates and allows them to add new templates.

- Approve ACH Templates: Customer can approve someone else’s add/edit of a template.

- Approve Own ACH Template: Customer can approve their own add/edit of a template.

- ACH Approve Tax: Allows user to approve ach tax file submitted.

- Wire Transfer Access: Allows customer access to perform wires.

- Wire Transfer Access Without Templates: Allows the user to build a wire from scratch (without a template)..

- Wire Transfer Approve: Allows user ability to approve wire transfers .

- Wire Transfer Approve Own: Allows user ability to approve their own wire transfers.

- Modify Wire Templates: Allows customer to add/edit wire templates.

- Approve Wire Templates: Allows customer to approve add/edits of wire templates.

- Approve Own Wire Templates: Allows customers to approve their own add/edits of wire templates.

- Wire Transfer Reject: Allows a user to reject a wire transfer .

- Wire Transfer Delete: Allows a user the ability to delete a wire transfer.

- Wire Transfer Delete Own: Allows a user the ability to delete their own wire transfer.

- Positive Pay Access: Allows user access to view positive pay account activity and exceptions.

- Positive Pay Issued Items: The ability to create issued items. Requires Positive Pay Access.

- Positive Pay Decisions: The ability to accept/reject exception decisions. Does not impact ACH Filtered Items. Requires Positive Pay Access.

Note: These settings control default settings. These can be overridden at the customer level on an account-by-account basis on the Security >> Customers tab >> Edit User. Business Owners must have all three permissions--Positive Pay Access, Positive Pay Issued Items, and Positive Pay Decisions--enabled in order to enable/disable these permissions for sub-users.

- View Statements: Allows user access to view statements through digital banking .

- New Notices: Allows user access to view notices through digital banking.

- View Statement With Images: Allows user access to view statements with images.

- View Account Details: Allows user ability to view account details (transaction history, pending items, transfers/payments).

- ACH Credit Transaction Limit: The dollar limit a customer would have on a single ACH credit transaction.

- ACH Debit Transaction Limit: The dollar limit a customer would have on a single ACH debit transaction.

- ACH Daily Credit Limit: The dollar limit a customer can perform in a day for ACH credits.

- Ach Daily Debit Limit: The dollar limit a customer can perform in a day for ACH debit files.

- Ach Weekly Credit Limit: The dollar limit a customer can perform in a week for ACH credits.

- Ach Weekly Debit Limit: The dollar limit a customer can perform in a week for ACH debits.

- Ach Monthly Credit Limit: The dollar limit a customer can perform in a month for ACH credits.

- Ach Monthly Debit Limit: The dollar limit a customer can perform in a month for ACH Debits.

- Ach Batch Credit Limit: The dollar limit a batch can amount up to for credits.

- Ach Batch Debit Limit: The dollar limit a batch can amount up to for debits.

- Wire Daily Limit: The dollar limit of wire transactions a user can perform in a day.

- Wire Weekly Limit: The dollar limit of wire transactions a user can perform in a week.

- Wire Monthly Limit: The dollar limit of wire transactions a user can perform in a month.

- Wire Transaction Limit: The dollar limit of a single wire transaction.

- Tax Daily Limit: The dollar limit a customer can perform in a day for tax payments.

- Tax Weekly Limit: The dollar limit a customer can perform in a week for tax payments.

- Tax Monthly Limit: The dollar limit a customer can perform in a month for tax payments.

- Tax Transaction Limit: The dollar limit a customer can perform for a single tax payment.

- Outbound Transaction Limits: Applies to external transfers and the dollar amount they can submit for a single outbound transaction .

- Outbound Daily Limit: Applies to external transfers and the dollar limit that they can submit daily for outbound transactions.

- Inbound Transaction Limit: Applies to external transfers and the dollar limit that they can submit for a single inbound transaction.

- Inbound Daily Limit: Applies to external transfers and the dollar limit that they can submit daily for inbound transactions.

- OOBA Positive Pay Exceptions: Requires OOBA at the positive pay exception process.

- OOBA ACH Approval: Requires OOBA at the ach approval process.

- OOBA Tax Payment Approval: Requires OOBA at the tax payment approval process.

- OOBA Wire Approval: Requires OOBA at the wire approval process.

- OOBA Access Cash Management: Not in use.

- OOBA External Transfers: Requires OOBA when performing an external transfer.

- OOBA Bill Pay Access: Requires OOBA when accessing bill pay.

- OOBA Sub User Save: Requires OOBA when saving sub-user settings/changes.

- OOBA iPay Payment Scheduling: Requires OOBA when scheduling iPay payments.

- OOBA P2P: Requires OOBA when performing a P2P transaction.

- OOBA Remote Deposit Capture: Requires OOBA when performing remote deposit capture.

- OOBA Add Payee: Requires OOBA when adding a new payee.

- OOBA ACH Access: Requires OOBA when accessing ACH.

- OOBA Wire Access: Requires OOBA when accessing wire functionality.

- OOBA Positive Pay Access: Requires OOBA when accessing Positive Pay.

- Transactions Per Page: Controls default transaction listing amount.

Loans:

- Make Payment: Allows customer to make a payment on the loan.

- Make Payment External: Allows customer to use external account to pay loan.

- Advances: Allows customer to perform advance on the account.

- View Statements: Allows user access to view statements through digital banking .

- New Notices: Allows user access to view notices through digital banking.

- View Statement With Images: Allows user access to view statements with images.

- View Account Details: Allows user ability to view account details (transaction history, pending items, transfers/payments).

CDs:

- View Statements: Allows user access to view statements through digital banking .

- New Notices: Allows user access to view notices through digital banking.

- View Statement With Images: Allows user access to view statements with images.

IRAs:

- View Statements: Allows user access to view statements through digital banking .

- New Notices: Allows user access to view notices through digital banking.

- View Statement With Images: Allows user access to view statements with images.

32135

|

Customer Portal

Customer Portal

Send Feedback

Send Feedback

Print

Print  Customer Portal

Customer Portal

Send Feedback

Send Feedback

Print

Print