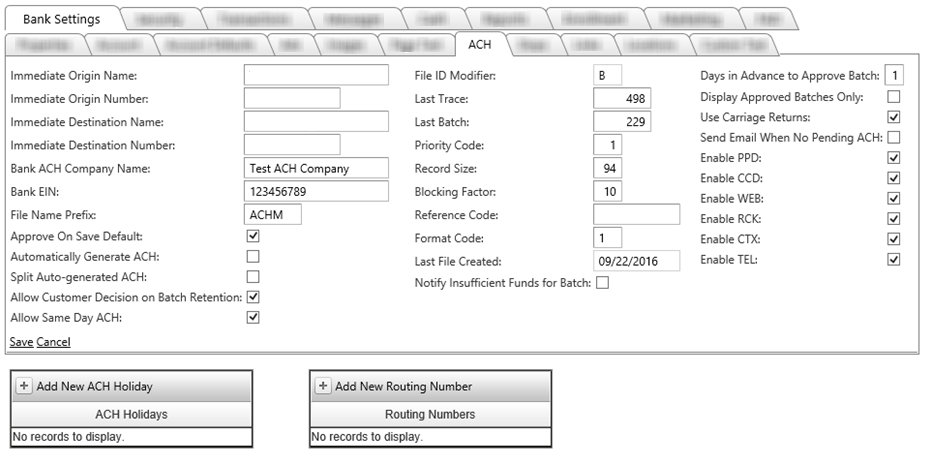

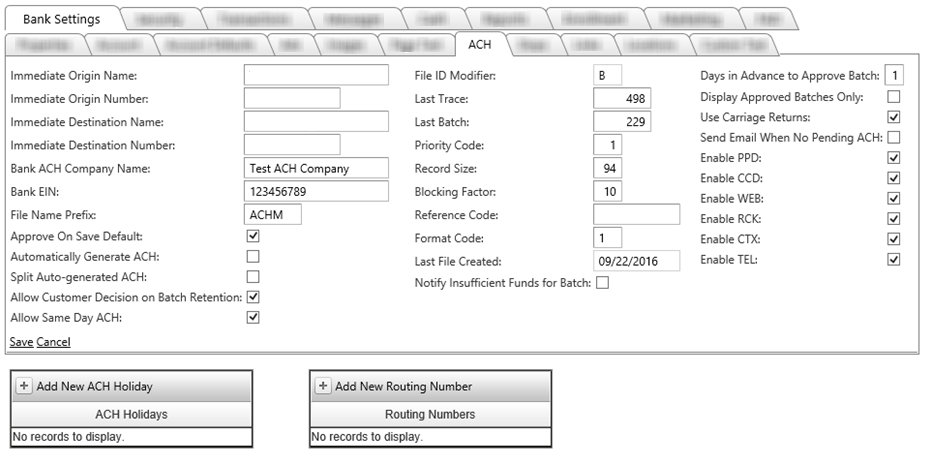

ACH tab

Cash management customers may want to create ACH origination files. This tab allows maintenance of file formats and file management. CSI personnel will input this information with the initial installation.

- Immediate Origin Name: This field is the originator's name. If the bank corresponds through the Fed, this should be the bank short name as determined by fed. If the bank corresponds with the third-party correspondent, they may require their name. In this case, the bank should check with their correspondent to verify requirements.

- Immediate Origin Number: Bank’s routing number.

- Immediate Destination Name: This would be the name of the Federal Reserve Bank you clear out of.

- Immediate Destination Number: This will be the Routing number of the Federal Reserve Bank you clear out of.

- Bank ACH Company Name: This field is used for external accounts. Most often, the bank’s ACH company name will be the same as the bank name but the bank may make it different if they wish. This field matches the length and type specification from the ACH rulebook. The Bank ACH Company field allows up to 16 characters to be entered. This field is required if the bank wishes to use external accounts.

- Bank EIN: This field is used for external accounts. This field matches the length and type specification from the ACH rulebook. The Bank EIN field allows up to 9 numerical characters to be entered. This field is required if the bank wishes to use external accounts.

- File Name Prefix: This is the first several characters of the name of the origination file created within the digital banking system.

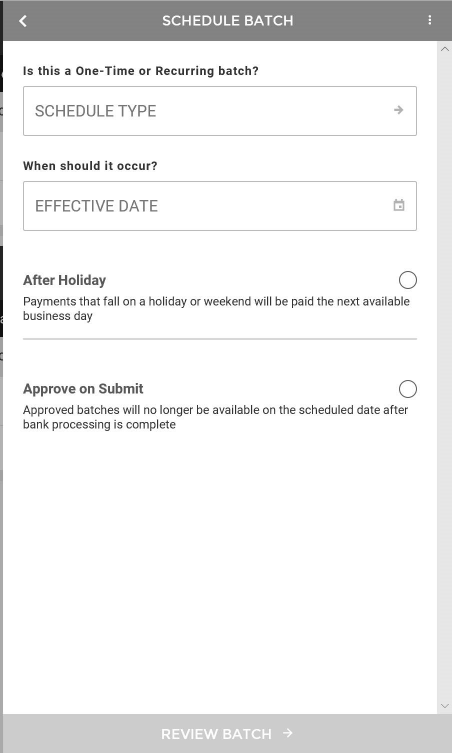

- Approve On Save Default: When the option is enabled, the Approve On Save option is enabled by default on the Cash Manager >> ACH >> Edit Batch screen. This option is marked by default when the “Approve On Save Default” option is enabled but can be unmarked if the user desires to do so. When the “Approve On Save Default” option is disabled, the Approve On Save option is not marked by default but can be marked if the user desires to do so.

- Automatically Generate ACH: This option determines whether or not a bank will have to manually approve batches and create ACH files. If this is on, a file will be automatically created and moved to where the NuPoint file mover system can access it.

- Split Auto-generated ACH: This option is used in conjunction with the previous option and determines whether or not the file is split up between on-us and transit when it is automatically created.

- Allow Customer Decision on Batch Retention: No longer used.

- Allow Same Day ACH: When enabled, displays an Allow Same Day ACH option on the Edit Customer >> User tab, which will allow you to enable customers to submit Same Day ACH batches.

File ID Modifier: file identifier to distinguish between multiple files

- Last Trace: This +1 will be the next trace number used when creating an ACH file. This field will increment by one for each item created for ACH Origination.

Last Batch: This +1 will be the next trace number used when creating an ACH batch. This field will increment by one for each batch created for ACH Origination

Priority Code: sets the priority code in the file header

Record Size: number of characters per line; default is 94

Blocking Factor: sets the NACHA file blocking factor; default is 10

Reference Code: optional field you may use to describe a file for internal purposes

Format Code: will always be ‘1’

- Last File Created: This is the date of the last file that was created by the digital-banking website. This field is for informational purposes only.

- Notify Insufficient Funds for Batch: Default is disabled. When enabled, customers are notified when the credits of the batch exceed the amount of the offsetting account's available balance. A notification will also be displayed when uploading both NACHA and Comma-Delimited ACH files.

- Days in Advance to Approve Batch: Determines how many business days in advance a batch shows up on the Cash >> Approve ACH screen. Bank employees may now see and work batches up to three business days in advance. Any batches that have effective dates that occur beyond the number in the "Days in Advance to Approve Batch" field will continue to be visible to the customer. However, these batches will not be visible to bank employees until they are within the correct number of days in advance as set in the new field.

- Display Approved Batches Only: Once a batch that has been approved by a customer gets unapproved by the bank, the batch disappears from the bank’s Approve ACH tab and is sent back to the customer as unapproved. If this option is unchecked, the bank will be able to see all batches that are within their set number of days prior to the effective days, regardless of whether the customer has approved them or not.

- Use Carriage Returns: Selecting this box will cause the system to put in carriage return/line feeds at the end of each line in the ACH file. Default is not checked for Fed.

- Send Email When no Pending ACH: An email is sent to the bank at their ACH processing cutoff time if they have any pending ACH batches to be worked. This checkbox will send an email even when there are no pending ACH batches waiting to be processed. This will allow the Employee to receive notification of all ACH activity even when the activity is that there is nothing to be processed.

- Allow ACH Filters for Whitelisting: When enabled, corresponding transactions are displayed in Edit Customer and you can grant access there.

- Allow ACH Filters for Companies: When enabled, corresponding transactions are displayed in Edit Customer and you can grant access there.

- Allow ACH Filters for SEC Codes: When enabled, corresponding transactions are displayed in Edit Customer and you can grant access there.

- Allow ACH Filters for Transactions: When enabled, corresponding transactions are displayed in Edit Customer and you can grant access there.

- Enable PPD: Check this field to allow this originating entry class for creating ACH batches.

- Enable CCD: Check this field to allow this originating entry class for creating ACH batches. This also enables a Child Support form on the Cash Manager >> ACH tab.

- Enable WEB: Check this field to allow this originating entry class for creating ACH batches.

- Enable RCK: Check this field to allow this originating entry class for creating ACH batches.

- Enable CTX: Check this field to allow this originating entry class for creating ACH batches.

- Enable TEL: Check this field to allow this originating entry class for creating ACH batches.

- Add New ACH Holiday: This calendar allows a bank to set up Bank Holidays and ACH Holidays separately, which was desired by several banks that are open on FED holidays. This allows banks to process their transaction and nightly files on these types of holidays by not setting the date as a bank holiday and lets them leave their ACH processing alone by setting the holiday as an ACH Holiday. If a date is set as an ACH holiday but not a bank holiday, ACH batch advancement will not occur but bank processing will occur as usual. Please note that on holidays that the bank does observe and is closed, you will need to set those dates in both the Bank Holiday Calendar and the ACH Holiday Calendar.

- Add New Routing Numbers: This field allows multiple ABA numbers. This would be used for those cases where banks have been merged or a bank purchased another bank requiring the use of multiple routing numbers.

19434

|

Customer Portal

Customer Portal

Send Feedback

Send Feedback

Print

Print  Customer Portal

Customer Portal

Send Feedback

Send Feedback

Print

Print